如何开发 pump.fun 智能合约 - 带源码

- CoinsBench

- 发布于 2025-04-24 15:20

- 阅读 3628

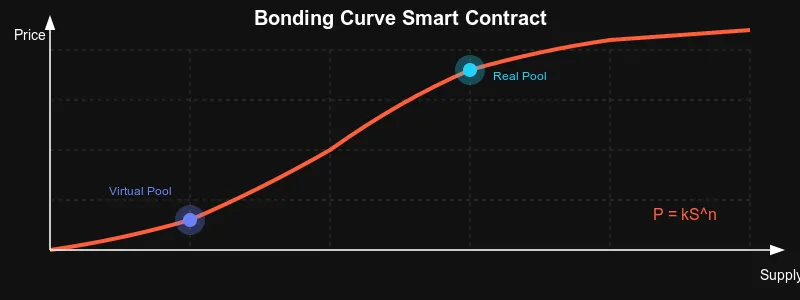

Pump.fun 创新性地使用连接曲线机制来解决流动性问题, 本文带领大家实现一个 pump.fun

如何像 pump.fun 一样编写 Bonding 曲线合约

Pump.fun 创新性地使用连接曲线机制来解决流动性问题。在 pump.fun 之前,如果一个 meme 项目想要推出代币,他们需要在 Twitter 上请求人们发送 SOL,然后等待他们收集到足够的资金在 DEX 上提供流动性,最后启动 meme 代币。

这种方法引入了几个信任问题:

- 发送 SOL 后,项目创建者可能不会分配代币(纯欺诈)

- 分配代币后,创建者可能不会部署 DEX 池(欺诈)

- 即使在部署 DEX 池后,创建者也可能撤回流动性(依然是欺诈)

Pump.fun 通过智能合约执行解决了这些问题:

- 代币以预定价格出售;发送 SOL 的用户会立即收到代币

- 一旦达到资金目标,流动性池会自动部署,从而消除欺诈风险

- DEX 池使用销毁的 LP 代币创建,使撤回流动性变得不可能

这优雅地解决了上述三个问题。

pump.fun 实际上是如何工作的?

- 它基于基本的 AMM 流动性公式:A×B = K

- 购买代币 A 时,支付代币 B 的数量为:b = aB/(A-a)

- 出售代币 A 时,获得的代币 B 数量为:b = aB/(A+a)

所以 A 和 B 分别对应代币和 SOL,但当 B 从 0 开始时,我们如何计算这个?

Pump.fun 智妙地引入了虚拟池的概念,假设在虚拟池中有 30 SOL 和 1,073,000,000 代币。这个虚拟池用于定价代币,后续的交易计算基于这个虚拟池,巧妙地实现了代币价格计算。

合约实现

基于 Anchor 框架,连接曲线数据的结构如下:

struct BondingCurveLayout {

blob1: u64,

pooled_token: u64,

pooled_sol: u64,

real_token: u64,

real_sol: u64,

total_supply: u64,

state: bool,

}这代表了 pump 的连接曲线状态。

以下是代币定价的计算方式:

struct AmmPool {

token_a: u64,

token_b: u64,

}

impl AmmPool {

fn buy_token_a_price(&self, token_amount: u64) -> Result<u64, String> {

if token_amount >= self.token_a {

return Err("买入太多".to_string());

}

if token_amount == 0 {

return Err("买入太少".to_string());

}

let new_token_a = self.token_a - token_amount;

let price = U256::from(self.token_b);

let price = price.mul(U256::from(token_amount));

let price = price.div(U256::from(new_token_a));

if let Some(real_price) = price.as_u64() {

return Ok(real_price);

}

Err("支付过多".to_string())

}

fn sell_token_a_return(&self, token_amount: u64) -> Result<u64, String> {

let new_token_a = U256::from(self.token_a);

let new_token_a = new_token_a.add(U256::from(token_amount));

if new_token_a.eq(&U256::zero()) {

return Err("售卖太少".to_string());

}

let temp = U256::from(self.token_b);

let temp = temp.mul(U256::from(token_amount));

let price = temp.div(new_token_a);

if let Some(real_price) = price.as_u64() {

if real_price > self.token_b {

return Err("超过了池中代币".to_string());

}

return Ok(real_price);

}

Err("支付过多".to_string())

}

}核心合约函数

CreateToken

pub fn create_bonding_curve(ctx: Context<CreateBondingCurve>, params: Box<CreateTokenParams>) -> Result<()> {

msg!("开始创建连接曲线 1 ");

if params.version >= ctx.accounts.settings.configs.len() as u8 {

return Err(err::SwapError::InvalidParamsVersion.into());

}

let seeds = &["icta".as_bytes(), &[ctx.bumps.mint_authority]];

let signer = &[&seeds[..]];

create_metadata(&ctx, ¶ms, &signer)?;

let config = &ctx.accounts.settings.configs[params.version as usize];

ctx.accounts.bonding_curve_account.version = params.version;

ctx.accounts.bonding_curve_account.pid = ctx.program_id.clone();

ctx.accounts.bonding_curve_account.mint = ctx.accounts.mint.key().clone();

ctx.accounts.bonding_curve_account.vrt = config.init_virtual_token;

ctx.accounts.bonding_curve_account.vrs = config.init_virtual_sol;

ctx.accounts.bonding_curve_account.rrt = config.max_sell_count;

ctx.accounts.bonding_curve_account.rrs = 0;

ctx.accounts.bonding_curve_account.osc = config::MAX_OVER_SELLING_COUNT;

ctx.accounts.bonding_curve_account.it = config.total_supply;

ctx.accounts.bonding_curve_account.supply = config.total_supply;

ctx.accounts.bonding_curve_account.state = config::CurveState::Running;

mint_to(CpiContext::new_with_signer(

ctx.accounts.token_program.to_account_info(),

MintTo {

mint: ctx.accounts.mint.to_account_info(),

to: ctx.accounts.ic_ata.to_account_info(),

authority: ctx.accounts.mint_authority.to_account_info(),

},

&signer,

),

ctx.accounts.bonding_curve_account.supply)?;

let clock = Clock::get()?;

emit_cpi!(config::CreateEvent{

event: config::EventType::CreateBondingCurve,

name: params.name.clone(),

symbol: params.symbol.clone(),

uri: params.uri.clone(),

user: *ctx.accounts.payer.to_account_info().key,

curve: *ctx.accounts.bonding_curve_account.to_account_info().key,

mint: *ctx.accounts.mint.to_account_info().key,

version: params.version,

ts: clock.unix_timestamp,

});

Ok(())

}Buy

pub fn buy(ctx: Context<BuyFromCurve>, params: Box<TradeParams>) -> Result<()> {

msg!("开始购买: {:?}", params);

if params.token_amount < config::MIN_BUY_TOKEN_COUNT {

return Err(err::SwapError::TokenAmountTooSmall.into());

}

let version = ctx.accounts.bonding_curve_account.version as usize;

if version >= ctx.accounts.settings.configs.len() {

return Err(err::SwapError::InvalidParamsVersion.into());

}

let curve_config = &ctx.accounts.settings.configs[version];

let real_amount = price::get_buy_amount(&ctx.accounts.bonding_curve_account, ¶ms)?;

let sol_price = price::buy_token_a(

ctx.accounts.bonding_curve_account.vrt,

ctx.accounts.bonding_curve_account.vrs,

real_amount)?;

let sol_fee = price::get_fee_from_x(ctx.accounts.settings.fee_point, sol_price)?;

let total_cost = sol_price.checked_add(sol_fee).ok_or(err::SwapError::InvalidArgument)?;

if total_cost > params.sol_amount {

return Err(err::SwapError::ExtendSlippage.into());

}

let destination = &ctx.accounts.to_ata;

let source = &ctx.accounts.from_ata;

let token_program = &ctx.accounts.token_program;

let authority = &ctx.accounts.bonding_curve_account;

let source_amount = source.amount;

if source_amount < real_amount + curve_config.least_remain_count {

msg!("源金额{}, 实际金额{}, 最少保留金额{}", source_amount, real_amount, curve_config.least_remain_count);

return Err(err::SwapError::TooManyToBuy.into());

}

let seeds = &["ic".as_bytes(), ctx.accounts.mint.to_account_info().key.as_ref(), &[ctx.bumps.bonding_curve_account]];

let signer = &[&seeds[..]];

let cpi_accounts = SplTransfer {

from: source.to_account_info().clone(),

to: destination.to_account_info().clone(),

authority: authority.to_account_info().clone(),

};

let cpi_program = token_program.to_account_info();

let cpi_tx = CpiContext::new(cpi_program, cpi_accounts).with_signer(signer);

token::transfer(cpi_tx, real_amount)?;

let from_account = &ctx.accounts.payer;

let to_account = &ctx.accounts.bonding_curve_account;

if from_account.lamports() < total_cost {

msg!("账户余额:{}, 总费用 {}", from_account.lamports(), total_cost);

return Err(err::SwapError::PayerInsufficientSol.into());

}

let transfer_instruction = system_instruction::transfer(&from_account.key(), &to_account.key(), sol_price);

anchor_lang::solana_program::program::invoke_signed(

&transfer_instruction,

&[...- 翻译

- 学分: 0

- 分类: Solana

- 标签: pump.fun Solana bonding curve

点赞 0

收藏 2

分享

本文参与登链社区写作激励计划 ,好文好收益,欢迎正在阅读的你也加入。

- 原生Solana:程序入口与执行 64 浏览

- 原生 Solana :读取账户数据 60 浏览

- Solana 系统调用:sBPF 汇编中的日志记录 57 浏览

- 指令处理器和运行时设置 56 浏览

- Solana 程序执行与输入序列化 50 浏览

- 跟踪 sBPF 指令执行和计算成本 54 浏览

- 原生 Solana: 函数分发 55 浏览

- 使用 sBPF 汇编读取 Solana 指令输入 53 浏览

- Solana 程序代码结构 36 浏览

- Solana - Switchboard 预言机使用 70 浏览

- 原生 Solana:关键安全检查 51 浏览

- 原生 Solana:创建存储账户 二 53 浏览

0 条评论

请先 登录 后评论